De Beers and Alrosa depleted their rough inventories in the first quarter, leading to unusually low availability in the second. De Beers has also reported operational challenges at some of its mines.

Several insiders expected a further price increase at De Beers’ June sight next week. Meanwhile, buyers are turning to tenders to plug shortages, lifting prices there to significantly above the large miners’ levels, sources explained.

“Over the past two sights, both Alrosa and De Beers have sold fewer goods [than earlier in the year],” a sightholder commented. “Their mining is also not very high. When I speak to them, they really don't have the goods that they can put on sale, especially in 4 grainers [1-carat rough] and up.”

The upcoming sight, which begins on Monday, will see proceeds similar to last month’s $380 million, dealers estimated — down from $663 million, $550 million and $450 million in the miner’s first three sales of the year. The combination of solid demand and limited supply means customers will snap up the merchandise, the sources added.

“I wouldn’t say that polished demand is completely bonkers, but you’ve got quite a destocked pipeline and…a restriction in rough coming in,” an insider observed. “These things together have [put us in] this…position.”

Reduced operations during India’s Covid-19 outbreak have exacerbated the polished shortfalls. While manufacturing and exports have been allowed to continue, factories and offices in India are limited to 50% of staff members. Many polishing workers have been sick or in quarantine, or have returned to their hometowns.

Demand for grading

Manufacturing has fallen to 60% of capacity in many categories under 0.18 carats, and to 75% in uncertified goods weighing 0.20 carats and higher, India’s Gem & Jewellery Export Promotion Council (GJEPC) said in an email interview with Rapaport News. Production of diamonds destined to receive grading reports has remained relatively high at 90%, the organization said.

This dynamic has piled pressure on the GIA. The backlog that has existed at its Indian laboratories since early this year has barely eased amid capacity restrictions. Diamonds submitted to the Mumbai lab on June 2 will be ready on July 2, or July 8 in Surat, according to the GIA’s website. The process usually takes around half of that time.

“It will have an effect on the industry, as the goods are blocked,” the GJEPC commented. “This can result in delay in sales and cash-flow constraint[s]. Hopefully, if the Covid-19 situation improves, we should see the cycle coming back to normal, i.e. 15 days.” The GIA was unavailable for comment at press time.

There are concerns that polished will flood the market when the GIA releases the backlog, and that the current scramble for stones is already weighing on profit margins. The price growth in rough has far outstripped that of polished, a manufacturer noted.

“At today’s prices, if I were to buy anything at a tender, I can barely cover my overheads,” he said.

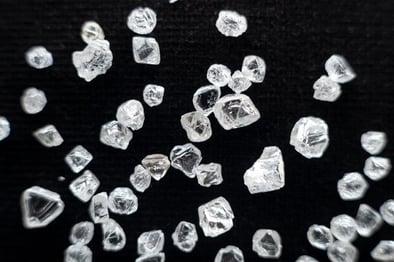

Image: A polished diamond during grading at De Beers Group Industry Services in Surat, India. (Ben Perry/Armoury Films/De Beers)

De Beers Raises Prices of Larger Diamonds

Jun 7, 2021 9:47 AM By Joshua Freedman

RAPAPORT... De Beers increased prices of goods above 2 carats at this week’s sight as shortages of rough coincided with strong polished demand.

Prices rose around 5%, and more in some categories, market insiders told Rapaport News on Monday. Near-gem items also saw significant increases, while prices for other stones under 2 carats were either stable or slightly up.

“They seem to have picked areas where they’ve seen room [for price growth], and they’ve just hiked the prices up,” a source in the rough sector said on condition of anonymity. “For the time being, the market is absorbing it.”

Rough trading has been strong in recent weeks because of reduced supply from the large miners and solid polished sales. The RapNet Diamond Index (RAPI™) for 1-carat diamonds has risen 2.5% since May 1.

Rough above 1 carat has been especially sought-after, with premiums on the secondary market rising while manufacturers look to fill inventory gaps. A backlog of grading submissions at the Gemological Institute of America (GIA) has exacerbated the situation.

The June sight value will be similar to last month’s $380 million as customers snap up the limited goods available at the sale, sources said. Proceeds were higher earlier in the year — peaking at $663 million in January — when manufacturers restocked after the holidays and De Beers had larger volumes available to sell.

“There’s a shortfall in goods,” an executive at an Indian sightholder said Monday. “They’re not able to serve everyone what they’re entitled to.”

Rough demand slumped during the 2020 coronavirus crisis as the global supply chain froze. De Beers chose to maintain prices until August, when it offered deep discounts to encourage sightholders to resume buying. It has since reversed those cuts, gradually bringing prices to above pre-pandemic levels in many categories.

The sight began on Monday and runs until Friday. De Beers was not available for comment at press time.ndia is experiencing a shortage of diamonds as rough supply has dropped and polished goods remain stuck at the Gemological Institute of America (GIA).

Traders are struggling to source rough, and face rising prices when buying from miners and at tenders, Indian manufacturers told Rapaport News this week. This has made it hard to meet strong demand from the US and China.

“[Buying] rough has become difficult in the sense that people are paying crazy prices,” a manufacturing executive said on condition of anonymity. “You have demand, but you don’t have the supply of raw material.”

De Beers and Alrosa depleted their rough inventories in the first quarter, leading to unusually low availability in the second. De Beers has also reported operational challenges at some of its mines.

Several insiders expected a further price increase at De Beers’ June sight next week. Meanwhile, buyers are turning to tenders to plug shortages, lifting prices there to significantly above the large miners’ levels, sources explained.

“Over the past two sights, both Alrosa and De Beers have sold fewer goods [than earlier in the year],” a sightholder commented. “Their mining is also not very high. When I speak to them, they really don't have the goods that they can put on sale, especially in 4 grainers [1-carat rough] and up.”

The upcoming sight, which begins on Monday, will see proceeds similar to last month’s $380 million, dealers estimated — down from $663 million, $550 million and $450 million in the miner’s first three sales of the year. The combination of solid demand and limited supply means customers will snap up the merchandise, the sources added.

“I wouldn’t say that polished demand is completely bonkers, but you’ve got quite a destocked pipeline and…a restriction in rough coming in,” an insider observed. “These things together have [put us in] this…position.”

Reduced operations during India’s Covid-19 outbreak have exacerbated the polished shortfalls. While manufacturing and exports have been allowed to continue, factories and offices in India are limited to 50% of staff members. Many polishing workers have been sick or in quarantine, or have returned to their hometowns.

Demand for grading

Manufacturing has fallen to 60% of capacity in many categories under 0.18 carats, and to 75% in uncertified goods weighing 0.20 carats and higher, India’s Gem & Jewellery Export Promotion Council (GJEPC) said in an email interview with Rapaport News. Production of diamonds destined to receive grading reports has remained relatively high at 90%, the organization said.

This dynamic has piled pressure on the GIA. The backlog that has existed at its Indian laboratories since early this year has barely eased amid capacity restrictions. Diamonds submitted to the Mumbai lab on June 2 will be ready on July 2, or July 8 in Surat, according to the GIA’s website. The process usually takes around half of that time.

“It will have an effect on the industry, as the goods are blocked,” the GJEPC commented. “This can result in delay in sales and cash-flow constraint[s]. Hopefully, if the Covid-19 situation improves, we should see the cycle coming back to normal, i.e. 15 days.” The GIA was unavailable for comment at press time.

There are concerns that polished will flood the market when the GIA releases the backlog, and that the current scramble for stones is already weighing on profit margins. The price growth in rough has far outstripped that of polished, a manufacturer noted.

“At today’s prices, if I were to buy anything at a tender, I can barely cover my overheads,” he said.

Image: A polished diamond during grading at De Beers Group Industry Services in Surat, India. (Ben Perry/Armoury Films/De Beers)